-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

High-Low Agreements Can Prevent Large Plaintiff Verdicts

Publication

Medical Marijuana and Workers’ Compensation

Publication

Secondary Peril Events Are Becoming “Primary.” How Should the Insurance Industry Respond?

Publication

Risks of Underinsurance in Property and Possible Regulation

Publication

Benefits of Generative Search: Unlocking Real-Time Knowledge Access

Publication

Battered Umbrella – A Market in Urgent Need of Fixing -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Publication

Thinking Differently About Genetics and Insurance

Publication

Post-Acute Care: The Need for Integration

Publication

Trend Spotting on the Accelerated Underwriting Journey

Publication

Medicare Supplement Premium Rates – Looking to the Past and Planning for the Future U.S. Industry Events

U.S. Industry Events

Publication

The Future Impacts on Mortality [Video] -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Upward Pressure On Umbrella Loss Ratios Has Grabbed Our Attention – Has It Caught Yours?

April 05, 2023

Maria Slowinski

,

Karen Tuomi

Region: North America

English

Umbrella loss ratios have been increasing over the past several years and many companies are reacting. Through the third quarter of 2022, Commercial Umbrella premiums in the CIAB space increased by double digits for 12 consecutive quarters.1 Multiple Personal Umbrella filings across the country, from mutual and stock companies alike, have been approved for 2023 rate increases in the high single digits and higher.

What is driving this distress in the Umbrella market? And what can companies do to actively maintain a healthy Umbrella product?

Causes of Umbrella Loss Ratio Pressure

Over the last 10 years severity trends have been on the rise, impacting Personal and Commercial Umbrella products.

U.S. tort costs rose on average 6% a year from 2016 to 2020, with personal liability at 4.4% and commercial liability at 6.9%.2 These rates far exceed the growth rates in inflation (1.9%) and GDP (2.8%) during that time. It’s interesting to note that only $0.53 of every dollar paid in the tort system in 2020 made its way to claimants; the remainder went to litigation costs and other expenses.3

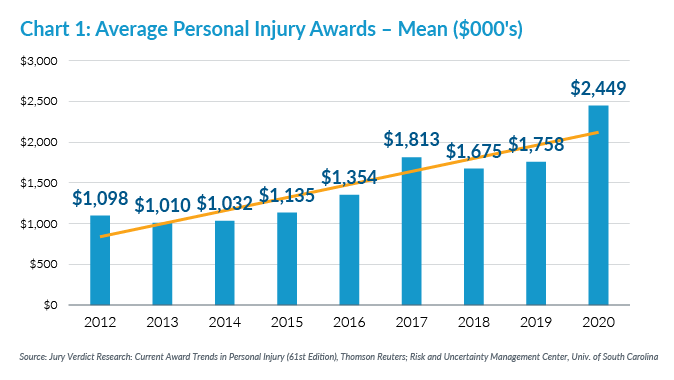

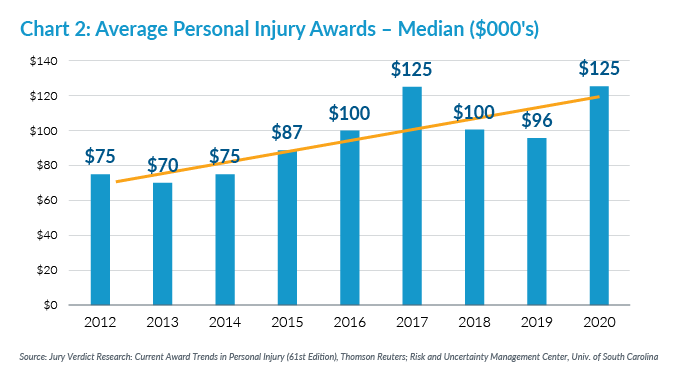

Mean (average), and median (midpoint) personal injury jury awards were 123% and 67% higher in 2020 than in 2012 respectively.4 Contrast this with the fact that minimum required underlying policy limits during that time have predominantly remained unchanged.

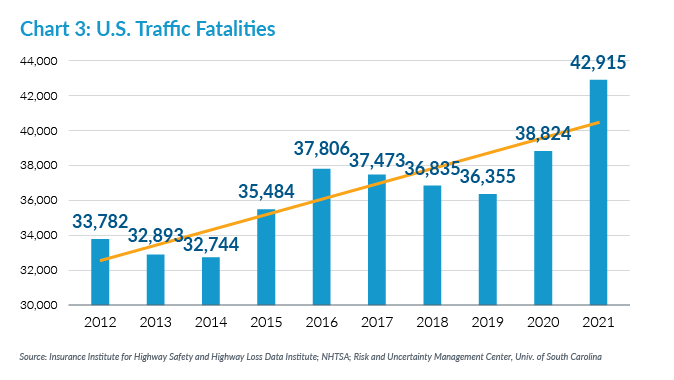

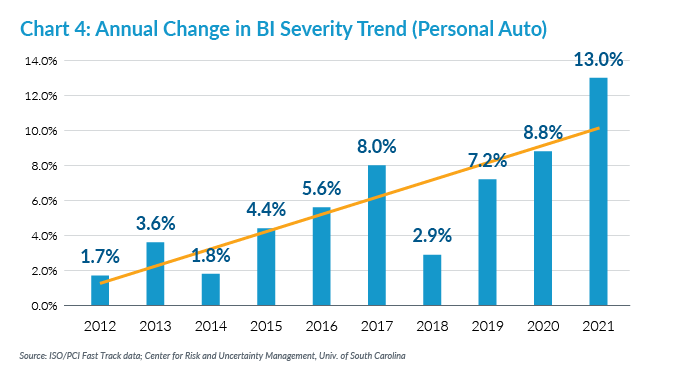

The number of deaths on U.S. roads is a proxy for claim severity. Chart 3 shows a clear upward trend in the number of traffic fatalities from 2012 to 2021. This is complemented by a jump in personal auto bodily injury severity trend, as seen in Chart 4, which regularly ran in the low single digits 10 years ago and hit 13% in 2021. Since auto claims drive Personal Umbrella claims and can play a large role in Commercial Umbrella claims, these auto trends should be igniting the interest of all Umbrella carriers.

We know that Umbrella claims are often recognized much later than primary claims, and slow development pushes full claim recognition even further into the future. This is particularly true for carriers who don’t write the primary policy associated with the claim. Covid-related court delays in recent years may add to the volatility of Umbrella loss ratio indications. Accordingly, favorable Umbrella loss ratios in 2020‑2022 may not be indicative of a profitable product today.

Also consider:

- Chubb North America Commercial P&C recognized $96,000,000 of unfavorable development in 2022 from their Commercial Umbrella / excess portfolios, driven by higher-than-expected loss emergence and increases in their claims severity trend assumptions.5

- In their most recently approved Commercial Umbrella filing in Georgia, Liberty Mutual estimates expected loss ratio trend for Commercial Umbrella to be 15.5% annually.6

- Safeco’s February 2023 Personal Umbrella filing in Kansas notes that “Due to the increase in high severity auto losses being experienced across the industry, we must increase umbrella rates to ensure that we are able to pay future claims.”7

The Importance of a Healthy Umbrella Product

“We will address the Umbrella product in a year or two.”

“Our Umbrella product is so small compared to the rest of our portfolio.”

“Our company hasn’t had enough Umbrella losses to be concerned.”

These can be common reactions when the subject of Umbrella product updates is raised. Understandably, for many carriers the Umbrella product isn’t a top priority. Companies must weigh the repercussions of a poor Umbrella loss ratio against the effort required to maintain the product. What consequences might result from an increase in Umbrella loss activity? Could the health of a company’s balance sheet be at risk? Are ceding commissions susceptible to reduction on heavily reinsured Umbrella products? Will long-overdue filings asking for substantial rate increases be rejected? How will Umbrella insureds react to extreme premium or coverage changes?

Is there any product that remains strong over time when ignored? Umbrella requires the same attention as any other line of business.

Levers Available for Improving the Umbrella Loss Ratio

Rate increases are typically the first corrective action that comes to mind, and for a volatile product like Umbrella, producing reliable proof of rate need may seem formidable. Companies can cite severity trends, either in the industry or their own primary lines. Long overdue rate adjustments should be pointed out; compounding years of high severity loss trend with little-to-no-rate increases will automatically raise an Umbrella’s expected loss ratio. Are minimum premiums and ILFs adequate and comparable to those of peers?

It can’t be overstated that it is much easier on state regulatory agencies, and insureds, if rates are adjusted routinely and incrementally, rather than drastically in reaction to intensifying loss activity.

Rates are not the only lever available to companies looking to strengthen their Umbrella loss ratios. Other options exist that may require less of a time commitment or fewer resources than a rate increase.

Raising required attachment points could go a long way toward improving Umbrella loss ratios. Higher underlying limits could be required for all Umbrella accounts, or only for tougher exposures like youthful and senior drivers on Personal Umbrellas, and large / heavy fleets for Commercial Umbrellas. Was it the 1980s when the standard underlying CGL limit for Commercial Umbrella increased to $1 million?

In several recently filed Personal Umbrella filings, RLI increased the required underlying auto liability limit to $500,000 BI each person / $500,000 BI each accident / $500,000 Property Damage. If insureds carry lower limits of $250,000 each person / $500,000 each accident, or $300,000 each person / $300,000 each accident a premium surcharge will apply.8

Another available lever is the amount of capacity being offered. Recognizing the existence of limits drift (the propensity for larger claim settlements to occur when larger limits are available) and higher severity trends, companies might consider restricting available capacity on accounts with large loss activity or more hazardous exposures.

Successfully underwriting Umbrella business requires recognition of severity exposure and the value of a company’s capacity. For underwriters who regularly handle primary lines of business this necessitates a mind shift away from frequency underwriting. Conducting Umbrella training might help underwriters more smartly deploy the Umbrella product.

Address the Volatility Today

Like primary lines of business, the Umbrella product should be regularly reviewed. While the Umbrella premium is often smaller than other product lines in a portfolio, the losses are more volatile. And, in the current environment of high severity trends, routine Umbrella maintenance becomes even more critical.

Bad things do happen, every single day. And those occurrences are getting more costly, with no hope of moderation in sight. A few years in a row with inadequate rate change, while loss costs are rising, puts a company in a jam and their product in jeopardy.

At Gen Re, we have been providing Umbrella reinsurance for over 55 years and have written close to $9 billion in premium to date. We offer a unique level of Umbrella support to our clients, including proprietary rating models, loss trend analysis, underwriting reviews, coverage form analysis, underwriter training and claims assistance, as well as marketing assistance. If you’d like to discuss your Umbrella product with us, contact your Account Executive today.

Endnotes

- The Council of Insurance Agents & Brokers, Commercial Property/Casualty Market Index Q4/2022

- U.S. Chamber of Commerce Institute for Legal Reform Tort Costs in America: An Empirical Analysis of Costs and Compensation of the U.S. Tort System, November 2022, https://instituteforlegalreform.com/research/tort-costs-in-america-an-empirical-analysis-of-costs-and-compensation-of-the-u-s-tort-system

- Ibid.

- Insurance Information Institute, “Facts + Statistics: Trends in Personal Injury Lawsuits,” https://www.iii.org/fact-statistic/facts-statistics-product-liability#Trends%20In%20Personal%20Injury%20Lawsuits,%202014-2020%20(1)

- Chubb Form 10-K, February 24, 2023

- Office of Commissioner of Insurance and Safety Fire Georgia, SERFF Public Access, SERFF # LBRC-133561972

- Kansas Insurance Department, SERFF Public Access, SERFF # LBPM-133533177

- TN: SERFF# RLSC-133506070, TX: SERFF# RLSC-133470228, ND: SERFF# RLSC-133505437, MI: SERFF# RLSC-133491718