-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

High-Low Agreements Can Prevent Large Plaintiff Verdicts

Publication

Medical Marijuana and Workers’ Compensation

Publication

Secondary Peril Events Are Becoming “Primary.” How Should the Insurance Industry Respond?

Publication

Risks of Underinsurance in Property and Possible Regulation

Publication

Benefits of Generative Search: Unlocking Real-Time Knowledge Access

Publication

Battered Umbrella – A Market in Urgent Need of Fixing -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Publication

Thinking Differently About Genetics and Insurance

Publication

Post-Acute Care: The Need for Integration

Publication

Trend Spotting on the Accelerated Underwriting Journey

Publication

Medicare Supplement Premium Rates – Looking to the Past and Planning for the Future U.S. Industry Events

U.S. Industry Events

Publication

The Future Impacts on Mortality [Video] -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Battered Umbrella – A Market in Urgent Need of Fixing

November 30, 2023

Matt Burns

,

Paul Kelejian

Region: North America

English

The sustained uptick in loss activity on Personal and Commercial Umbrella products is a growing concern for insurers. Vulnerable loss limits, elevated case values, and aggravated damages are fast becoming the new normal. Despite the challenges they face, insurers can and should take steps in both underwriting and claims management to mitigate losses.

Loss Ratios Trending Upwards

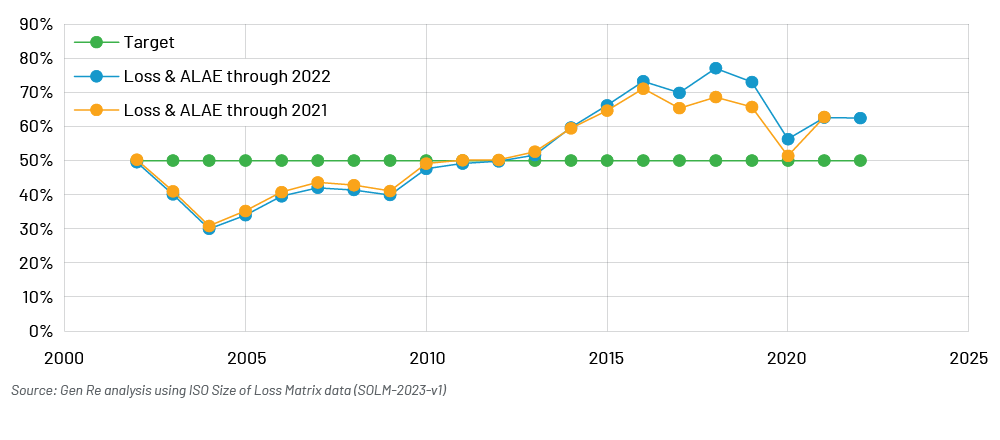

Commercial Umbrella loss ratios started rising in 2012 and, although there was a Covid-related dip, the upward trend has continued as courts work through the lockdown backlog. The message is clear: A decade ago an average single-person loss that would be contained in primary limits is now well into Umbrella limits, and the tail associated with Commercial Umbrella claims has likely been underestimated.

There’s nothing materially different in terms of the character of the risks, but pricing simply hasn’t kept pace with claims and inflation. Many insurers are relying on rate increases in primary lines to earn into the Umbrella. However, Umbrella rates, Increased Limit Factors (ILFs) and minimum premiums have largely remained unchanged.

While some positive rate is flowing into the Umbrella, it tends to be limited to the first or second million of Umbrella limits, with excess limit pricing remaining virtually unchanged. Compounding this, and despite the severity, Umbrella limits have been readily available and provided as a matter of course. As companies put up more capacity, when they do have a loss (or multiple losses), there’s not enough premium to keep the loss ratio at an adequate level.

Commercial Umbrella Loss Ratios – since 2002

The pressures on Umbrella loss ratios took many package underwriters by surprise because, historically, Umbrella products don’t receive the same continuity of underwriting attention as primary lines. The reality is that case values are up significantly from where they were a decade ago. Companies that experienced minimal to no Umbrella loss content historically are seeing increased activity. Even carriers with established portfolios and dedicated Umbrella underwriters are seeing an uptick in both frequency and severity of Umbrella losses. As a result, small and large carriers alike are revisiting their Commercial Umbrella strategy. In addition to pricing considerations, many have taken to reducing limits and/or restricting class eligibility. While the “reset” strategy is sound, the nature of Commercial Umbrella loss and the related tail portend several years of potential adverse development.

Plaintiffs Bar Ups the Ante

Increased (and tougher) plaintiff attorney involvement has played a role in rising costs, but the whole claims environment is conducive to it. Soaring social inflation, nuclear verdicts, a sophisticated plaintiffs bar, litigation funding, and higher frequency and severity due to distracted driving and/or cell phone usage, for example, are the main factors.

As insurers and reinsurers, we expect losses, and we meet our obligations – that’s why we’re here. But the extent to which the loss dollars are flowing and how aggressively they’re being pursued is concerning. Plaintiffs’ attorneys are focused on finding negligence and extending it to gross negligence, where losses go much further than expected. Hedge funds are also getting in on the funding litigation act, and now even smaller carriers are in their sights.

A smaller mutual company may think it’s safe because they only put up $5 million in limits, but we’ve seen examples where plaintiffs’ attorneys pull them in, along with a few other companies, so the plaintiffs can compile the limits.

Here are a few recent examples where aggravating circumstances resulted in either larger awards or multiple policies combined to compile limits:

- A property owner/landlord settled for $4 million – $5 million, with smaller insurers representing other interests paying out in excess of $10 million as multiple policies responded to a premises liability loss in Philadelphia.

- An off-duty police officer working as a security guard for the external premises of a store was named by the claimant, along with the property owner, in an incident that occurred inside the store. When cases are severe enough, any tangential activity that can compile limits can be enough to create an exposure.

- The Surfside condominium collapse in Florida saw the security company paying the bulk of that settlement, in part, a function of the limits the firm carried, despite other potentially more culpable defendants.

- Documented cell phone usage caused a head‑on collision that resulted in a leg amputation case with aggravating factors. It settled for more than $10 million policy limits.

- A child ingested a battery from a remote-control device, resulting in a products liability loss that required the distributor’s umbrella policy limits to resolve. The overseas manufacturer of the product escaped the U.S. litigation.

Warning – Aggravated Damages Ahead

What can insurers do to help mitigate losses? Sometimes it’s clear that claims are due to negligence on behalf of the insured, inadequate supervision, or a process that doesn’t meet code. Taking shortcuts, gross negligence, and/or reckless conduct on the part of the insured frequently leads to aggravated general damages and/or or punitive damages.

In instances where aggravated damages are awarded, the whole case value rises if a plaintiff can prove egregious conduct on the part of the insured. A common example is when the insured is unable to find qualified drivers, but they need to get their trucks on the road. The insured hires a newly licensed commercial driver and doesn’t have time to properly train them, or perhaps the insured didn’t do an adequate background check. Such shortcuts have the potential to result in an aggravated damages award.

Six Steps to Mitigating Aggravated Damages

Despite the challenges, underwriting and claims management by insurers can also help reduce losses. Here are six steps insurers can take to mitigate aggravated damages:

- Institute more ardent, casualty-specific loss control measures and be relentless with recommendation compliance.

- Identify additional insured risk transfer exposure early in the underwriting process.

- Avoid recycled risks – Marginal accounts always seem to find an unassuming new home.

- Be transparent in interactions with insureds.

- Identify and resolve problematic claims as early as possible.

- Review your processes and decisions after the fact to avoid making the same mistakes again.

A Carriers First Line of Defense – The Line Underwriter

Umbrella underwriting requires a different mindset than primary underwriting. It is not just an extension of the type of losses underwriters might be contemplating in the primary policy. This is where risk selection really comes into play, and where we see the most potential for things to go wrong.

Carriers need to do a little self-analysis: are they putting out too much limit? Are risks appropriately priced? Is underwriting properly executed? How can they mitigate some of the risk?

Whether a carrier is offering $1 million or $25 million of Umbrella limit, capacity should be reserved for best in class, adequately priced risks. Risk-return assessment is a skill set requiring constant reinforcement. While most underwriters are comfortable differentiating risks within the same class, they don’t always make the correlation when quoting or authorizing an Umbrella limit.

Also challenging is the Umbrella rating process, where quoting efficiencies, rating algorithms, and/or pricing worksheets have been designed to price to maximum limits. Over time, underwriters may become immune to the process, allowing the algorithm to make the decision of how much Umbrella limit can be offered and at what price. By its very nature, Commercial Umbrella can be highly leveraged (big limit, small premium), making the long-term success of the product dependent upon the underwriter making decisions that are aligned with, and independent of, their evaluation of primary lines (or, where applicable, all underlying insurance).

Going Forward

Carriers would do well to remember that Umbrella insurance was never intended to be a product that’s designed for losses every other year. The dramatic deterioration of the Umbrella market’s loss profile shows that insurers must take steps now to get loss ratios and allocated loss adjustment expenses back on target.

We encourage you to reach out to your Gen Re account executive with any questions. Whether it’s to do with underwriting, loss prevention techniques and tools, or claims management, we can help.