-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Trending Topics

Publication

Recycling of Large Lithium-Ion Batteries From a Property Insurance Perspective

Publication

Looks Like Inflation Is Sticking Around. What Do We Do Now? [Part 3 of 3]

Publication

The Future of Cryptography and the Rise of Quantum Computing

Publication

Personal Injury Compensation in Europe: An Updated Comparison Among Different Systems Within the European Market

Publication

How to Plan for Cat Claims - Before, During, and After an Event -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Training & Education

Publication

The Future Impacts on Mortality [Video]

Publication

Beware of Demo Mode on Electrocardiogram Reports

Publication

Understanding Breast Cancer in Asia – Awareness and the Importance of Screening

Publication

Marginal Gains in the Medicare Supplement Market U.S. Industry Events

U.S. Industry Events Moving The Dial On Mental Health

Moving The Dial On Mental Health -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Inflation Returns – Temporary Visit or Extended Stay? [Part 1 of 3-Part Series]

August 14, 2022

Ridge Muhly

,

Jonathan Rodgers, NAMIC Director of Financial and Tax Policy (guest contributor)

English

This is part one of our three-part series – in collaboration with NAMIC – examining inflation and its impact on insurers.

Among the many cascading events that COVID‑19 presented to the American people – the infusion of trillions of dollars of federal government COVID-relief spending into the economy, the ongoing supply chain disruptions, and the continued labor market struggles have all played a large role in contributing to the high inflationary environment currently impacting the U.S. economy. The return of long-dormant inflation ends what many have called the “free money” era in which inflation and interest rates hovered around zero. Consumers are suddenly feeling the pinch at the grocery stores and gas pumps, and in other consumer goods.

The insurance industry now finds itself in a morass of soaring automobile and building material costs, labor shortages and supply-chain struggles, as well as dealing with several outsized and out-of-season extreme weather events, all while inflation outpaces premium increases.1

As we approach 2023 with the tangible and intangible impacts of inflation’s unwelcome return continuing to be felt, the question is whether this inflationary era is only temporary, or will it prove to be long lasting? If the latter, how will the insurance industry be affected and what can be done to minimize the impact?

Where We Are Now

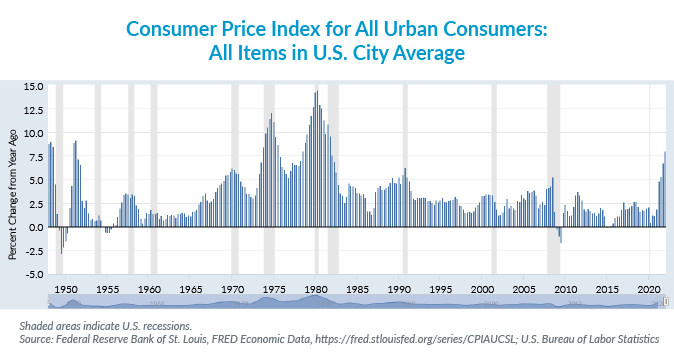

The Consumer Price Index (CPI) surged 1.3% in June 2022, while the annual inflation rate in the U.S. increased to 9.1% in the same month, the largest increase in four decades.2 The Property/Casualty insurance industry is experiencing the deleterious effects of these inflationary pressures firsthand, particularly in the Homeowners and Auto insurance lines, but also in the form of increased stress on investments in fixed-income instruments and loss reserves. Whether for repairs, parts/materials, the cost of labor, or any number of other variables relating to providing coverage, supply chain shortages and inflation invariably mean delays and higher costs.

Homes and Motor Vehicles

Homes and motor vehicles are among the largest contributors to the historically high inflation rates recorded of late. In June 2021 alone, the CPI for used cars and trucks registered an increase of 45.2% over June 2020. The National Auto Dealers Association reported that the average new car price surpassed $45,000 in January 2021 and the average used car price climbed to nearly $30,000. The National Association of Home Builders reported in November 2021 that prices of goods used in residential construction climbed 12.2% for the first 10 months of that year, after climbing 4.6% over the same period in 2020. Furthermore, housing is in high demand with historically low inventory resulting in homes appreciating at a record rate. In March 2022, the year-over-year increase in home prices nationwide, including distressed sales was 20.9%; however, some predict a cooling off period due in part to rising mortgage rates potentially derailing prospective buyers.3,4

We’ve Been Here Before

Inflation is not a static event – it is part of the economic cycle, and inflationary periods have defined the American economy at various points throughout history. In the immediate post-World War II period, for example, inflation spiked partly due to product shortages as manufacturing shifted from producing weapons to making consumer durable products.5 Moreover, consumers flush with savings, who had been getting by with aging cars and appliances on the brink of breakdown in the war-mobilized economy, helped fuel an extraordinary inflationary fire that culminated with the CPI peaking at 20.1% in March 1947.6 Over the next two years, as manufacturing completed its transition to peacetime production, demand subsided and inflation dramatically declined. This post-war period could also be characterized as a period of rising interest rates, as bond yields climbed persistently from 1946 to 1981.

Heightened inflation returned in the 1970s, ranging from 6% in 1973 to 14% in 1982. Driven in large part by multiple surges in crude oil prices, the inflation fever finally broke when the Federal Reserve raised interest rates from 10% to 20%.7 However, with the breaking fever came two crippling recessions that lasted until November 1982.8 Ultimately interest rates peaked in 1981 and went down persistently for the next 40 years. Given that inflation has been with us for more than a year and interest rates are starting to rise, it appears that the generational trend has reversed itself once more. While there is no way of knowing what will happen next, looking to the past may be instructive. Many people are confronting major inflation and interest rates going up for the first time in their lifetime.

As policymakers sift through potential solutions to the current inflationary cycle, one commentator suggests looking back to the aforementioned post-WWII period, given the similarities of supply shortages, forced savings, and renewed demand for consumer goods.9 Recall, this was also followed by a period of rising interest rates. Others suggest that we’re entering a new era marked by geopolitical tensions, protectionist policies, and natural disasters, all of which will continue to stress global supply networks and in turn fuel inflationary headwinds for years to come.10

Insurance Industry Under Inflationary Pressure

History confirms that the inflation of the 1970s and early 1980s had dramatic adverse effects on the insurance industry, leading to weakened underwriting quality and performance, reduced reserve levels, and increased rates for policyholders and consumers. Property/Casualty insurers will be challenged to stem the tide of an extended period of inflation and rising interest rates; however, strong balance sheets and capital positions have Property/Casualty insurers in a stronger position today than during the period of the late 1970s and 1980s.

In extended inflationary periods, insurers will be challenged to keep pricing and reserve levels up to pace with inflation. The Federal Reserve will likely continue to raise interest rates to try to head off inflation, challenging insurer portfolios heavily invested in fixed-income instruments (U.S. treasuries, municipal bonds, etc.).11 Historically, Property/Casualty insurers have invested between 10‑20% of their surplus in common stock to keep pace with inflation to pay claims (auto repairs, construction costs, healthcare expenses, and labor) that are growing with inflation.12

Higher expenses for insurance operations and inflated unanticipated loss cost increases result in higher incurred loss ratios, particularly as inflation impacts key cost factors such as construction costs, skilled labor, auto repairs/total vehicle replacement costs, and litigation costs. The insurance area continues to feel its greatest pain in sectors associated with these key cost drivers. Simply put, if costs to repair vehicles and homes increase, and/or if there are more claims or litigation activity associated with those claims, insurance premiums are likely to go up as well.

Reconstruction Costs

Total reconstruction costs, including materials and labor, shot up 13.5% from April 2021 to April 2022, almost doubling the increase between January 2021 and January 2022. Powering the surge were price hikes in lumber and fuel prices, as well as increases in the costs to produce and transport goods.13 Spikes in construction labor and material costs and/or shortages in labor mean higher repair costs and delays as contractors have difficulty finding skilled craft positions and as backlogs in work mount. A recent analysis by the Home Builders Institute estimates that the construction industry is facing a shortage of more than 200,000 skilled trade workers.14,15

Not surprisingly, reconstruction costs rose in all states, paced by Delaware (16.8%), New York (16.2%), and Connecticut (15.5%).16

Supply Chain Challenges

Specific inflationary pressures in the short-tail auto insurance markets relate to both parts and labor costs. Supply chain challenges are adding to already elevated costs of materials and parts, with procurement of the computer chips necessary for most newer vehicles presenting particular availability challenges. With fewer chips available, the cost of new vehicles and repairs involving these chips become significantly more expensive. At the same time, many auto repair shops are facing severe staffing shortages, leading to longer wait times and higher labor costs for consumers.

Social Inflation

In addition to economic inflation, evidence suggests we must also consider the impact of social inflation, which generally denotes untenable and increased litigation and claim costs. In 2021, NAMIC and Gen Re collaborated on a five-part series examining social inflation and its impact on insurers. The series highlights how the increase in litigation verdicts and costs causes extreme disruptions for insurers working to adequately price and reserve for their underwritten coverages. There are many sources that fuel social inflation and with increases in third-party litigation funding and non-economic damage recoveries, “nuclear verdicts” are trending towards becoming the rule rather than the exception.

Social inflation is also evident on the first-party side through the torrent of Assignment of Benefit claims in states such as Florida.17 And finally, the increasingly frequent shift of attorney fee awards away from the American Rule (that each party pays its own attorney fees and costs) and onto insurers is impacting the neutrality of litigants in courts of law. All of these practices can have negative effects on insurance marketplaces by fundamentally altering the balance and fairness of proceedings.

The Future

Noted economist Charles Goodhart says the world was in the midst of a seismic shift prior to the pandemic. He argues that a long period of inexpensive labor fueled by globalization served to keep prices and wages artificially low for decades.18 He further argues that shifting demographics – older populations and declining birth rates – are resulting in worker shortages and higher prices, adding that as a result inflation in developed economies will settle between 3% and 4%, compared to the roughly 1.5% that existed pre-pandemic.19 Others dispute this, claiming that declining numbers of workers and more retirees could actually drive inflation lower as has been recently seen in Japan.20

John H. Cochrane, senior fellow, Hoover Institution, and professor of finance at Stanford University, attributes the actions of the Fed, through its decade of purchasing Treasury securities and trillions of dollars of COVID-relief deficit spending, as contributing to the current high inflationary environment. In an article published by the National Bureau of Economic Research, he notes “inflation breaks out when the quantity of debt exceeds people’s expectations of repayment.”21 Based on this logic, absent an acknowledgment that the debt will be paid down, and/or that future deficit spending will be restrained, raising interest rates may make inflation worse. “In a fiscally driven inflation, it can happen that the central bank raises rates to fight inflation, which raises the deficit via interest costs, and thereby only makes inflation worse.”22 With $30 trillion of total federal debt outstanding, or 130% of 2021 U.S. Gross Domestic Product, interest payments will increase substantially in a rising interest rate environment.

Regardless of the differing forecasts, an emerging consensus suggests that inflation, while likely to not reach the double digits seen in the early 1980s, will nevertheless be with us for quite some time and possibly be exacerbated by geopolitical events or domestic monetary and fiscal policy. It appears that these uncertainties – for insurers and their individual and business customers – are the realities of the environment in which they operate.

Endnotes

- https://www.claimsjournal.com/news/national/2022/03/07/309044.htm

- https://www.bls.gov/cpi/

- https://www.corelogic.com/intelligence/u-s-home-price-insights/

- Case-Shiller Index Forecast

- https://www.ft.com/content/f6bf6064-a348-4f37-b784-5b9e7ba05448

- Ibid.

- https://www.insurancejournal.com/news/national/2021/03/23/606467.htm#:~:text= Inflation%2C%20defined%20as%20the%20rate,is%20chasing%20too%20few%20goods

- https://bancroft.berkeley.edu/ROHO/projects/debt/1980srecession.html

- https://www.ft.com/content/f6bf6064-a348-4f37-b784-5b9e7ba05448

- https://www.wsj.com/articles/new-age-of-scarce-supply-risks-inflationary-headwinds-challenging-central-banks-11651060801

- CNBC: https://www.cnbc.com/2022/07/27/fed-decision-july-2022-.html

- NAIC: https://content.naic.org/sites/default/files/capital-markets-special-report-cash-invested-assets-2019.pdf

- https://www.verisk.com/insurance/visualize/inflation-lifts-reconstruction-costs-as-fuel-prices-boost-volatility/#:~:text=Overall%20inflation%E2%80%94up%208.5%20 percent,the%20start%20of%20the%20pandemic

- https://us.milliman.com/en/insight/the-toll-of-increasing-construction-labor-and-supply-costs-on-insurance

- https://hbi.org/wp-content/uploads/Final-HBI-Construction-Labor-Market-Report-news-release-11-4-21.pdf

- Ibid.

- Assured Research, Assured Briefing, “Florida Homeowners’ Market Becoming Uninsurable?,” May 2022

- https://www.wsj.com/articles/inflation-high-forecast-economist-goodhart-cpi-11646837755#:~:text=He%20predicted%20that%20inflation%20in,Mr

- Ibid.

- Ibid.

- https://www.nber.org/system/files/working_papers/w30096/w30096.pdf

- Ibid.

Jonathan Rodgers serves NAMIC as the Director of Financial and Tax Policy. His responsibilities include representing member-company interests in the areas of solvency regulation, state and federal tax issues, and international policy affairs. He covers developments at the National Association of Insurance Commissioners and the International Association of Insurance Supervisors for any new standards or policy changes that impact U.S. property/casualty insurers.

Jonathan Rodgers serves NAMIC as the Director of Financial and Tax Policy. His responsibilities include representing member-company interests in the areas of solvency regulation, state and federal tax issues, and international policy affairs. He covers developments at the National Association of Insurance Commissioners and the International Association of Insurance Supervisors for any new standards or policy changes that impact U.S. property/casualty insurers.