-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Trending Topics

Publication

Recycling of Large Lithium-Ion Batteries From a Property Insurance Perspective

Publication

Looks Like Inflation Is Sticking Around. What Do We Do Now? [Part 3 of 3]

Publication

The Future of Cryptography and the Rise of Quantum Computing

Publication

Personal Injury Compensation in Europe: An Updated Comparison Among Different Systems Within the European Market

Publication

How to Plan for Cat Claims - Before, During, and After an Event -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Training & Education

Publication

The Future Impacts on Mortality [Video]

Publication

Beware of Demo Mode on Electrocardiogram Reports

Publication

Understanding Breast Cancer in Asia – Awareness and the Importance of Screening

Publication

Marginal Gains in the Medicare Supplement Market U.S. Industry Events

U.S. Industry Events Moving The Dial On Mental Health

Moving The Dial On Mental Health -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Property, Engineering, Marine

With Gen Re’s full range of products and highly trained specialists, you’ll find the reinsurance solution that’s right for you.

We offer Treaty and Facultative (Individual Risk and Program) reinsurance solutions for a broad range of Property exposures and coverages including:

Commercial Property, Personal Lines, Engineering, Agriculture, Marine, Boiler & Machinery, Machinery/Equipment Breakdown, and Natural Catastrophe perils. Our solutions can reduce volatility in your books and protect your company’s balance sheet. As a direct reinsurer, we underwrite and assess risk alongside you, sharing expertise and technical knowledge – all with the goal of helping you meet your reinsurance and business objectives.

Property

The risks in the commercial and industrial sectors are manifold and are characterized by rapid technological changes. Our Property reinsurance products fit a diverse client base across Commercial and Personal lines markets.

Our solutions address the volatility of losses as well as unique characteristics and exposures across the spectrum of Property risks, from Treaty and Facultative automatic programs to highly customized Facultative coverage on individual risks. Solutions include commercial properties, vacant/unoccupied buildings, rehabilitation/renovation, large commercial risks, homeowners with very high-valued dwellings, seasonal dwellings, farm/ranch owners, catastrophe-exposed locations, industrial, infrastructure, and many other types.

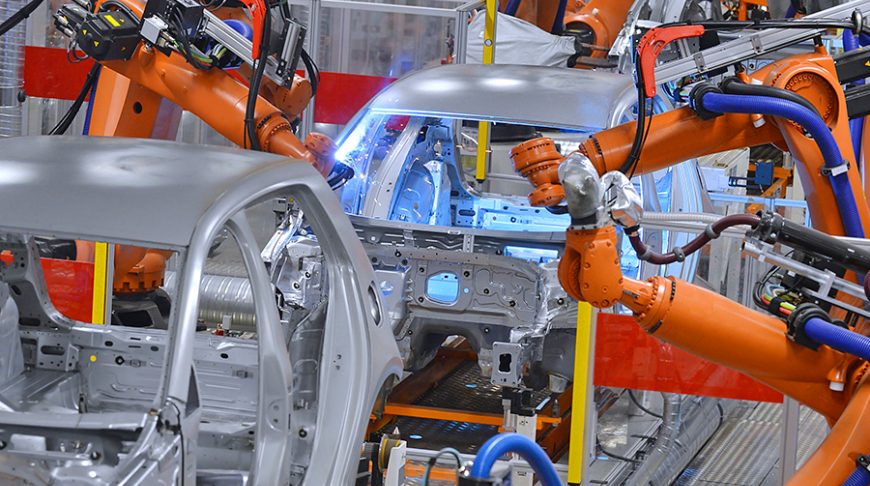

Engineering

Our specialty underwriting teams offer solutions on large, unusual, or complex occupancies, coverages, and perils. We can provide reinsurance protection for highly volatile risks such as Construction risks, Semi-conductor, Boiler and Machinery, and Equipment Breakdown.

Marine

We offer reinsurance solutions across a broad range of Ocean and Inland Marine exposures. To succeed in today's rapidly changing global environment, our teams combine global expertise with local know-how. Our product offerings include Ocean Cargo, Commercial Hull (Ocean/River), Yachts, Builders Risk, and Marine Liabilities.

Natural Catastrophe

Rising NatCat activity in recent years has created challenges for the insurance industry. In addition, supply chain and business interruption risks have exacerbated claims, making assets more exposed to losses. At Gen Re, an experienced team with a long-standing history in underwriting backed by a strong balance sheet will help you meet your reinsurance and business objectives.

Related Solutions

Autonomous Vehicles, Drones, and Our Future – The Exciting and Occasionally Bumpy Road Ahead

As autonomous vehicles and drones continue their inexorable march forward, life as we know it will change. Read about the technological changes on the horizon.

Timothy Fletcher

July 27, 2022

Golfanlagen – ein unterschätztes Risiko?

Golfplätze stellen bedeutende Sachwerte dar, die Dutzende bis Hunderte von Millionen Euro wert sind. Wir untersuchen potenzielle Brandrisiken auf Golfplätzen aus Sicht der Sachversicherung sowie mögliche Präventivmaßnahmen und geben Hinweise zur Risikobewertung und zum Underwriting.

Leo Ronken

January 10, 2024

Golf Clubs and Golf Courses – Underestimated Risks?

Golf courses represent a significant asset, worth tens to hundreds of millions of Euros. We examine the potential fire risks of golf courses from a property insurance perspective, as well as possible preventative measures, and provide advice on risk assessment and underwriting.

Leo Ronken

January 10, 2024

Inflation – What’s Next for the Insurance Industry and the Policyholders it Serves?

To varying degrees, inflation poses a continuing threat to the insurance industry. Yet, multiple indicators suggest the industry remains robust, steady, and safe. While certain lines of business are under stress, none are currently impaired. Read more about inflation's impact on the industry.

Timothy Fletcher

January 08, 2024

Secondary Peril Events Are Becoming “Primary.” How Should the Insurance Industry Respond?

Public attention is usually focused on catastrophes such as tropical storms and hurricanes, but more recently, smaller to mid-sized events – “secondary perils” – such as a severe convective storm, or floods and storm surge, seem more frequent. Learn more including some underwriting takeaways.

Timothy Fletcher

December 06, 2023