-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Recycling of Large Lithium-Ion Batteries From a Property Insurance Perspective

Publication

The Future of Cryptography and the Rise of Quantum Computing

Publication

Personal Injury Compensation in Europe: An Updated Comparison Among Different Systems Within the European Market

Publication

Looks Like Inflation Is Sticking Around. What Do We Do Now? [Part 3 of 3]

Publication

Motor Insurance in the Post-Pandemic Era -

Life & Health

Life & Health Overview

Life & Health

Gen Re’s valuable insights and risk transfer solutions help clients improve their business results. With tailor-made reinsurance programs, clients can achieve their life & health risk management objectives.

UnderwritingTraining & Education

Publication

The Future Impacts on Mortality [Video]

Publication

Thinking Differently About Genetics and Insurance Business School

Business School

Publication

Fraud Survey in the UK & Ireland Sheds Light on Insurer Best Practices

Publication

Fight Against Fraudulent Claims – Highlights From Our South African Survey Moving The Dial On Mental Health

Moving The Dial On Mental Health -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Critical Illness and Disability Insurance – Leveraging Coverage Potential [Part 1 of 3]

August 01, 2023

Ronald Schwärzler

English

Deutsch

Financial security is a fundamental need of many people. Just as Life insurance policies are often taken out to ensure that family members and others are well cared for in the event of death, what happens if one gets seriously ill or suffers a serious accident? In those cases, the financial needs of the family may be particularly high.

Critical Illness1 (CI) and Disability insurance products are available to remedy this situation. Although these are generally very useful for insured persons, such insurance plays a minor role in many insurance markets compared to pure Life insurance.

The design options and potential of these insurance products are perhaps not sufficiently known or appreciated globally.

This blog looks at the various ways in which these products can be designed. The most diverse needs of potential policyholders can be covered and, at the same time, insurers can have the opportunity to offer affordable insurance premiums.

CI insurance – a concept with many possibilities

CI insurance is characterised by a lump sum benefit payment upon diagnosis or the occurrence of a predefined illness or injury. In many markets, CI insurance policies exist with a variety of defined conditions, each of which can trigger a claim. In practice, cancer, myocardial infarction (heart attack) and stroke are by far the most common cause of an insured event.

We see that in CI products with many different benefit triggers, these three diseases often account for 80%–90% of claims, with cancer accounting for about 80% of claims in women.2,3 Cancer is also the most common cause of claims for men, but heart attacks and strokes are far more significant in this group, accounting for about 30% of claims in total.

In principle, a distinction must be made between two different concepts. First, there is the so‑called “accelerated CI benefit” that pays out all or part of the death benefit prematurely if a serious illness is diagnosed. On the other hand, there is the “standalone CI benefit” that can be taken out with or without life insurance. This is characterised by the benefit amount being often paid out only once the insured persons have survived for a certain period after the insured event.

The principle of CI insurance can be adapted to the needs of the customers in a variety of ways. The basic questions for structuring a CI insurance product are:

- Which conditions should the insurance cover?

- At what level of severity should benefits be paid?

In addition, it is possible to make the benefit amount dependent on the severity of the illness. For example, only a portion of the CI cover can be paid out if cancer is diagnosed at an early stage. If the cancer progresses, the remainder of the sum insured could be paid to the insured persons.

Moreover, CI insurance can be designed in such a way that it does not terminate when a serious illness is diagnosed, so that it provides financial protection for one or more other diagnoses during the insurance term. This may be of particular interest to the insured persons, as they usually have poor chances of taking out a new CI insurance policy or a similar insurance product after a serious illness.

Disability insurance – deferred period and degree of disability are key parameters

Disability insurance must be differentiated from CI insurance. The purpose of Disability insurance is less to cover the illness or injury of the insured persons per se, but rather to cushion the financial losses resulting from an accident or illness-related inability to work. For this reason, disability benefits are often monthly payments.

Disability insurance can be designed in different ways. For example, the insurance may be structured in such a way that a payment is made only when the duration of the inability to work exceeds a certain period (the deferred or deferment period; in some markets called the waiting or elimination period). With regard to incidence rates and the associated premium calculation, there are various levers that can be used when designing Disability insurance.

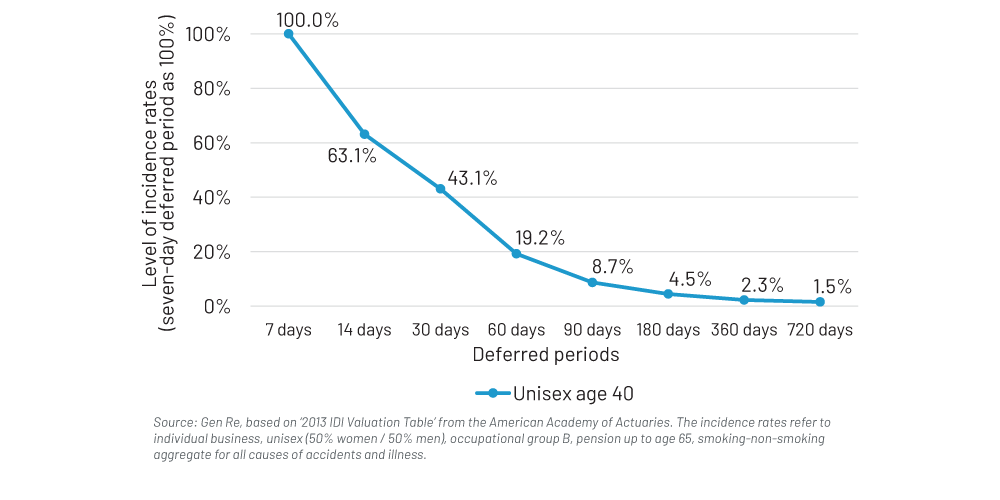

For example, the length of the deferred period has a significant influence on the probability of occurrence and thus on the amount of the premium. The chart below, based on US data, shows how deferred periods impact incidence rates as a percentage of a seven-day deferred period. Based on these data, the probability of occurrence in 40‑year-olds (50:50 men:women) decreases to 63% if the deferred period is increased from seven to 14 days.

This level decreases continuously with longer deferred periods, so that the deferred period is one of the most important factors in determining the amount of the insurance premium. In the case of Disability insurance with pension benefits, however, it should be noted that a change in the deferred period, and thus the probability of an insurance benefit, is not transferred one-to-one to the insurance premium, as short-term losses have a lower loss burden than long-term losses.

Influence of the Deferred Period on the Disability Incidence Rates in the US

In addition, the amount of inability to work required for the payment of an insurance benefit may be varied in order to adjust the insurance premium to the financial possibilities and needs of the customers.

For example, a possible trigger for benefits could be that the insured persons are no longer able to work at least 50% of their previous weekly working hours in their own occupation. Here, too, there are numerous options for reducing the number of insured events and thus offering cheaper insurance products. For example, an increase in the percentage of weekly working hours that can still be worked, and therefore the degree of disability, may be considered.

Another option is to maintain the chosen percentage of working hours that can still be worked while changing the benefit trigger so that the insured persons are not only unable to work in their own occupation but are no longer able to pursue any occupation at all. This tightens the conditions, as it is more likely that the insured persons will be able to pursue some occupation or other after a disabling event rather than just their previous occupation. While this makes the occurrence of the insured event less likely, the insurance premium can also be significantly reduced in favour of the insured persons.

In some countries, lump-sum instead of annuity payments for Disability insurance are common practice. However, these policies often pay only for a very high degree of severity that is permanent. These policies are generally referred to as total and permanent disability (TPD) insurance.

So, as explained, there is a large number of ways to vary both CI and Disability insurance policies in order to tailor the insurance product to the individual customer or specific customer groups.

Stay tuned for our next blog that looks at how it makes sense for CI and Disability insurance policies to be offered in combination to provide optimal cover. And then, we will present four innovative product combinations that could prove a valuable addition to a range of insurance products.

Endnotes

- Also known as ‘dread disease’, ‘severe disease’ or ‘trauma’ insurance

- Gen Re’s Dread Disease Survey: https://www.genre.com/knowledge/publications/2019/may/ri19-6-en.

- US CI Market Survey: https://www.genre.com/knowledge/publications/2022/september/surveylhci22-en.